GHB's Optimistic Outlook for 2025

The Government Housing Bank (GHB) is confidently moving towards its ambitious goal of approving 240 billion baht in housing loans by the end of 2025. This optimism persists even in the face of potential economic slowdowns, as stated by the bank's managing director.

Significant Achievements in the First Half

By the end of May, GHB had already approved 80 billion baht in loans, achieving 33% of its annual target. This marks a 30.75% increase from the previous year, showcasing strong progress.

Minimal Impact from Natural Events

Despite a recent earthquake in Myanmar that was felt in Bangkok, the transfer of condominium ownerships financed by GHB saw a 7.7% rise in the first quarter compared to last year.

Government Initiatives Boosting Growth

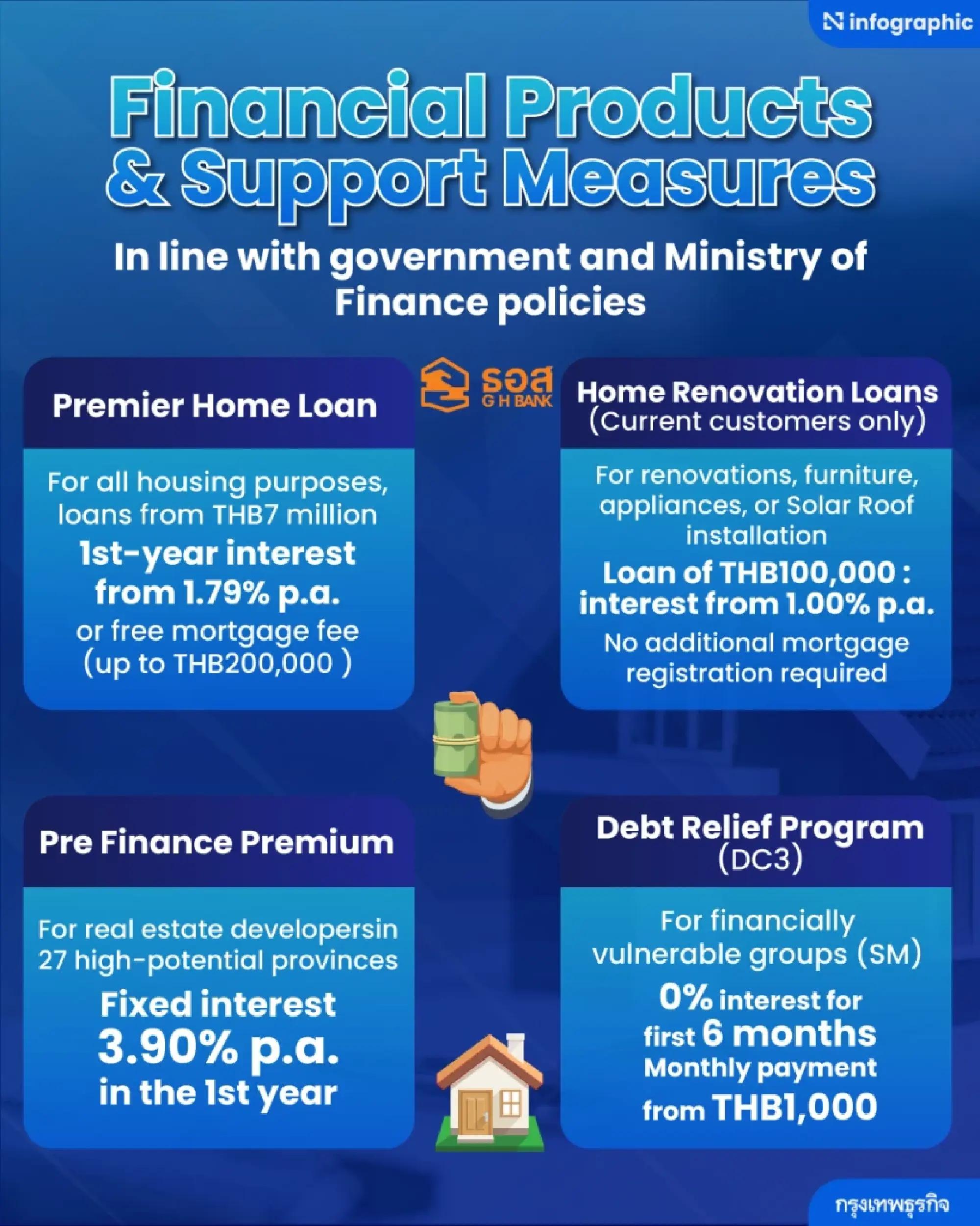

The Finance Ministry has directed GHB to enhance lending through key programs, including Home Renovation Loans, Premier Home Loans, and Senior Citizen Loan Programmes, aimed at stimulating the property sector and economy.

Supportive Policies Enhancing Loan Approvals

Government and Bank of Thailand measures, such as reduced fees for property transactions and eased loan-to-value requirements, are expected to further facilitate homebuyers' access to loans.

Maintaining Low Non-Performing Loans

GHB anticipates keeping its non-performing loans below 5.13% by year-end, thanks to 11 proactive measures designed to prevent defaults and support borrowers in financial distress.

Comprehensive Support for At-Risk Borrowers

The Debt Relief Programme offers tailored support, including interest-free periods and gradual payment increases, to help vulnerable borrowers avoid default.

Comments