Business Sentiment in Korea Continues to Decline

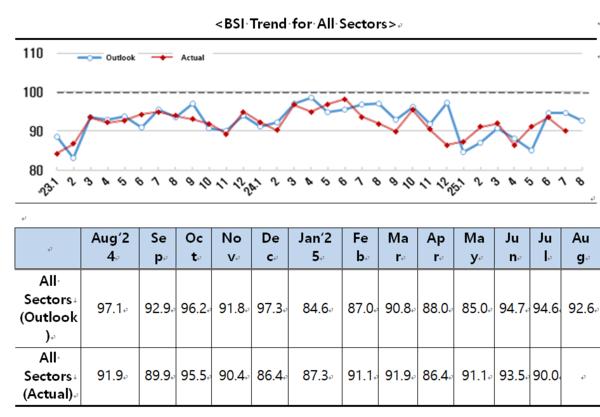

The Federation of Korean Industries’ (FKI) Business Survey Index (BSI) for August 2025 has recorded a concerning outlook of 92.6, marking a continuous decline below the baseline of 100 for over three years. This trend underscores the growing pessimism among Korea's top 600 companies regarding their business prospects.

Sector-Specific Challenges Emerge

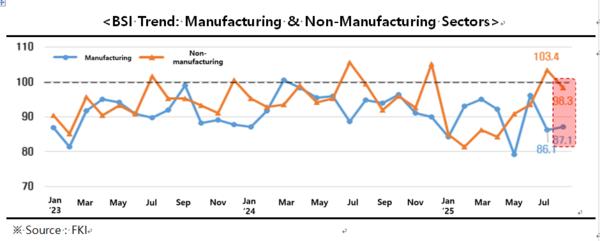

Both manufacturing and non-manufacturing sectors are bracing for negative impacts, with the manufacturing BSI at 87.1 and non-manufacturing at 98.3. The manufacturing sector's consecutive months in the 80s highlight the severe challenges faced, while the non-manufacturing sector's drop below the baseline signals a worrying shift in economic activity outlook.

Industries Under Pressure

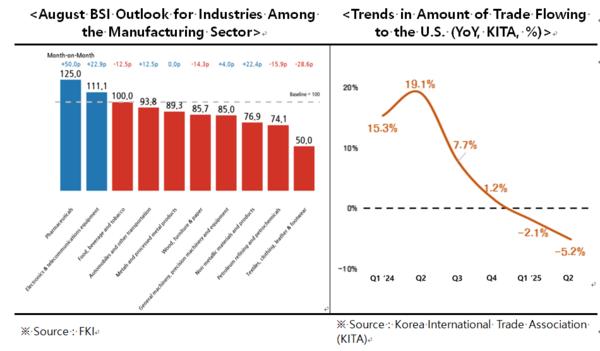

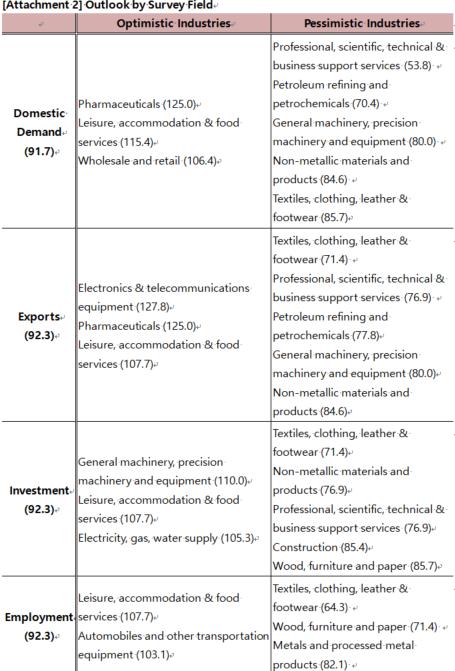

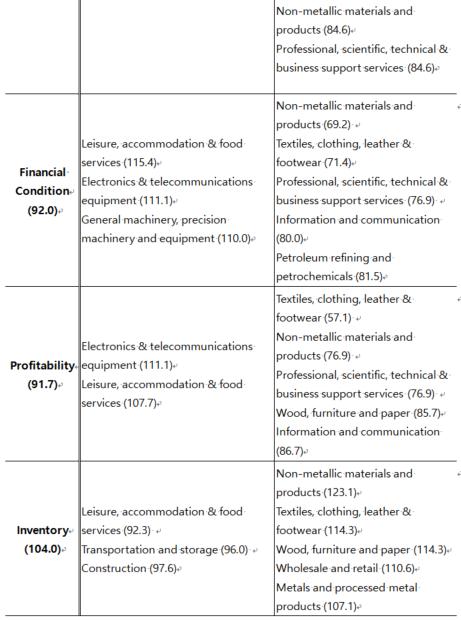

While Pharmaceuticals and Electronics & telecommunications equipment show resilience, seven other industries, including Textiles, clothing, leather & footwear, are struggling. The FKI points to U.S. reciprocal tariffs as a significant factor exacerbating the decline in export flows and overall business sentiment.

Call for Government Action

Lee Sang-ho of the FKI emphasizes the need for expansionary fiscal measures and improved trade policies to counteract the negative trends. The current economic climate, influenced by U.S. tariff policies and domestic demand slowdowns, poses a serious challenge to Korea's economic stability.

Outlook Across Sectors

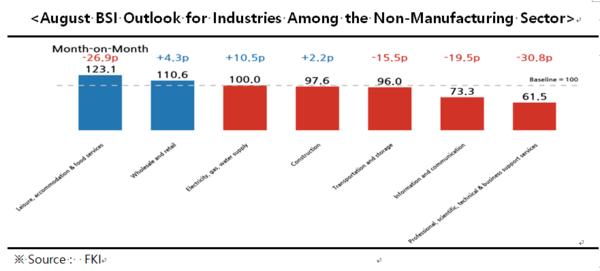

Detailed sector analyses reveal widespread challenges, with Light Manufacturing, Heavy Chemical Industry, and Non-Manufacturing sectors all reporting sluggish outlooks. The data underscores the pervasive impact of external and internal pressures on Korea's business landscape.

Comments