Bank of Korea Governor Calls for Stronger Macroprudential Policy Authority

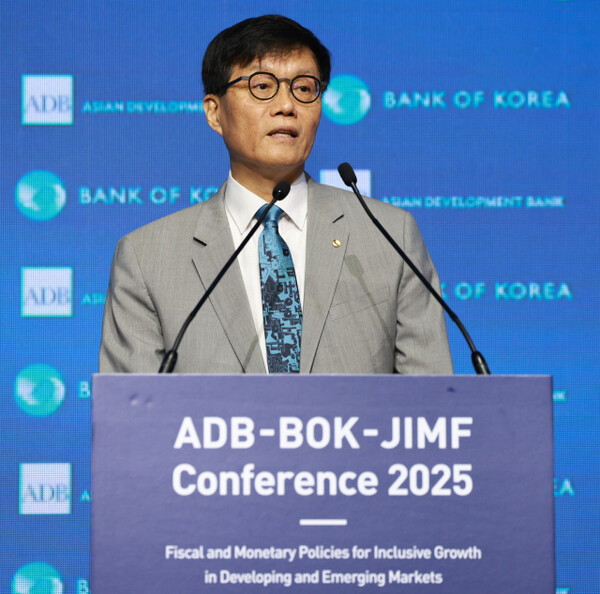

Bank of Korea Governor Rhee Chang-yong has once again highlighted the urgent need to bolster the central bank's role in macroprudential policy through enhanced legal and institutional frameworks.

During his keynote speech at a recent conference, Rhee pointed out the challenges faced by the Bank of Korea, including the lack of direct macroprudential policy tools and microprudential supervision authority, which could hinder prompt and effective policy responses.

In light of the new government's financial authority reorganization, the Bank of Korea is pushing for an expansion of its authority in macroprudential policy and financial institution supervision. This move was also reflected in the bank's recent business report to the National Planning Advisory Committee.

Rhee stressed the critical importance of policy coordination between the central bank and the government, using the interest rate reduction transition period in August 2024 as a prime example of necessary cooperation.

He also touched on the limitations of the current system, especially in addressing financial imbalances like household debt, and shared research findings on how higher household debt levels can constrain the economic stimulus effects of fiscal policy.

Comments