LG Uplus Takes Bold Step to Enhance Shareholder Value

In a significant move to boost shareholder value, LG Uplus has announced the cancellation of all 6,783,006 treasury shares it currently holds, effective August 5. This decision, representing 1.55% of total outstanding shares and approximately 100 billion won ($72.37 million), marks the company's first stock cancellation since its 2021 buyback. Additionally, LG Uplus plans an 80 billion won share buyback starting August 4, aiming to acquire 5,336,891 shares over one year.

Strategic Financial Targets and Shareholder Returns

Following its November value-up plan, LG Uplus is committed to mid-to long-term financial targets, including a return on equity (ROE) of 8 to 10% and a shareholder return ratio of 40 to 60%. The company also declared an interim dividend of 250 won per share for this year, building on its 2023 achievements of a 7.5% ROE and a 43.2% shareholder return ratio.

Operational Restructuring and Growth Strategy

Since the first quarter, LG Uplus has been restructuring its operations, focusing on profitability and qualitative improvement by discontinuing underperforming B2C platforms. This strategy has already shown positive results, with a 15.6% year-over-year increase in operating profit to 255.4 billion won in the first quarter.

Innovation Through AI Investment

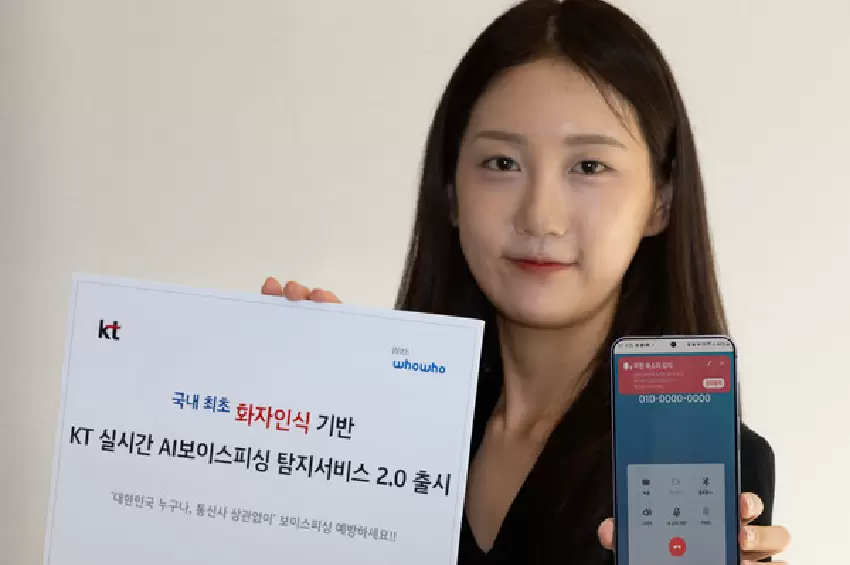

LG Uplus is also making strides in innovation, commercializing its AI voice-agent service ixi-O and introducing an Anti-Deep Voice feature to detect manipulated audio. Its AI customer service advisor has significantly reduced counsel time, showcasing the company's commitment to leveraging technology for efficiency.

Market Performance and Subscriber Growth

With aggressive shareholder returns and improved performance, LG Uplus's stock has seen a 31% increase since December last year. The company also reported a growth in mobile and fixed-line telecom service subscriptions, capturing 19.45% of the market as of May.

Comments